Zee Business Stock, Trading Guide: 10 things to know before market opens on 22 November 2022

Most sectoral indices traded in line with the benchmark and ended lower wherein realty, IT and energy were the top losers.

Zee Business Stock and Trading Guide: The Indian markets started the week on a feeble note and lost around a per cent, in continuation to the previous session’s fall. After the initial decline, Nifty traded in a narrow band till the end and settled closer to the day’s low at 18,159.95 levels.

The 30-share BSE Sensex declined 518.64 points or 0.84 per cent to settle at 61,144.84. During the day, it tumbled 604.15 points or 0.97 per cent to 61,059.33. Most sectoral indices traded in line with the benchmark and ended lower wherein realty, IT and energy were the top losers.

Here is a list of things to watch out for on 22 November 2022

What should investors do?

Participants should see the dip as normal profit taking after the recent surge and we expect the 17950-18050 zone to act as immediate support in Nifty.

While we’re seeing a mixed trend across sectors, resilience in the banking space is playing a critical role in capping the damage so far. We recommend continuing with a stock-specific trading approach and maintaining positions on both sides.

- Ajit Mishra, VP - Research, Religare Broking Ltd

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.81 per cent lower at 18,159. Key Pivot points (Fibonacci) support for the index is placed at 18135.89, 18105.44 and 18056.17, while resistance is placed at 18234.44, 18264.89, and 18314.17.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.21 per cent higher at 42,346. Key Pivot points (Fibonacci) support for the index is placed at 42241.64, 42198.17, and 42127.8, while resistance is placed 42382.37, 42425.84, and 42496.2.

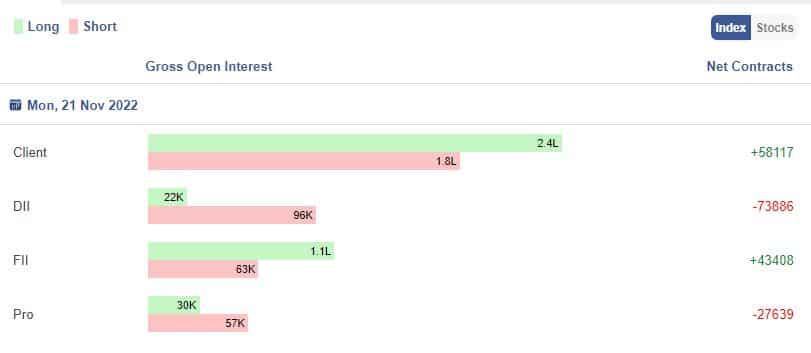

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News:

Reliance Industries: Jio receives NCLT approval for the acquisition of Reliance Infratel.

Oil stocks in focus: Brent & Nymex down 5% each on production increase plan by OPEC members.

Punjab National Bank appoints Binod Kumar as Executive Director from today.

Kirloskar Electric Company decides to recall 29 workmen who were laid-off at the company's Bhudihal (Unit-15) effective December 1, 2022.

Lupin signs MoU with Govt Of Rajasthan for the healthcare system.

Corporate Action

ASM Technologies Limited: Ex-date interim dividend 10% at Rs 1 per share

Container Corporation of India: Ex-date interim dividend 60% at Rs 3 per share

EID Parry: Ex-date interim dividend 550% at Rs 5.5 per share

IPCA Lab: Ex-date interim dividend 400% at Rs 4 per share

Pearl Global Industries: Ex-date interim dividend 25% at Rs 2.5 per share

The Great Eastern Shipping: Ex-date interim dividend 72% at Rs 7.2 per share

FII Activity on Monday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 1593.83 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 1262.91 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

Archean Chemical Ind Ltd: Quant Money Managers Limited sold 6,50,000 equity shares in the company at the weighted average price Rs 452.59 per share on the NSE, the bulk deals data showed.

Delhivery Limited: CA Swift Investments sold 1,84,04,607 equity shares in the company at the weighted average price Rs 330.02 per share on the NSE, the bulk deals data showed.

JTL Industries Limited: Dugar Growth Fund Private Limited sold 3,50,000 equity shares in the company at the weighted average price Rs 295.1 per share on the NSE, the bulk deals data showed.

Easy Trip Planners Ltd: Saint Capital Fund bought 22,00,000 equity shares in the company at the weighted average price Rs 52.5 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Escorts, GNFC, PNB, Sun TV and Indiabulls Housing Finance are placed under the F&O ban for Tuesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:52 PM IST

Bell Ringing Celebration: Anil Singhvi rings bell at BSE as Zee Business creates history with record 77.4% market share

Bell Ringing Celebration: Anil Singhvi rings bell at BSE as Zee Business creates history with record 77.4% market share Zee Business viewership reaches new milestone, market guru Anil Singhvi set to lead special coverage from 8 am on Tuesday

Zee Business viewership reaches new milestone, market guru Anil Singhvi set to lead special coverage from 8 am on Tuesday Traders' Diary: Buy, sell or hold strategy on Tata Motors, MGL, LIC, Zomato, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Tata Motors, MGL, LIC, Zomato, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on CIL, Inox Wind, Britannia, Dr Reddy's, Escorts Kubota, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on CIL, Inox Wind, Britannia, Dr Reddy's, Escorts Kubota, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on IOCL, Coal India, DLF, UBL, Cyient, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on IOCL, Coal India, DLF, UBL, Cyient, over a dozen other stocks today